Simple Tips About How To Find Out If You Have A State Tax Lien

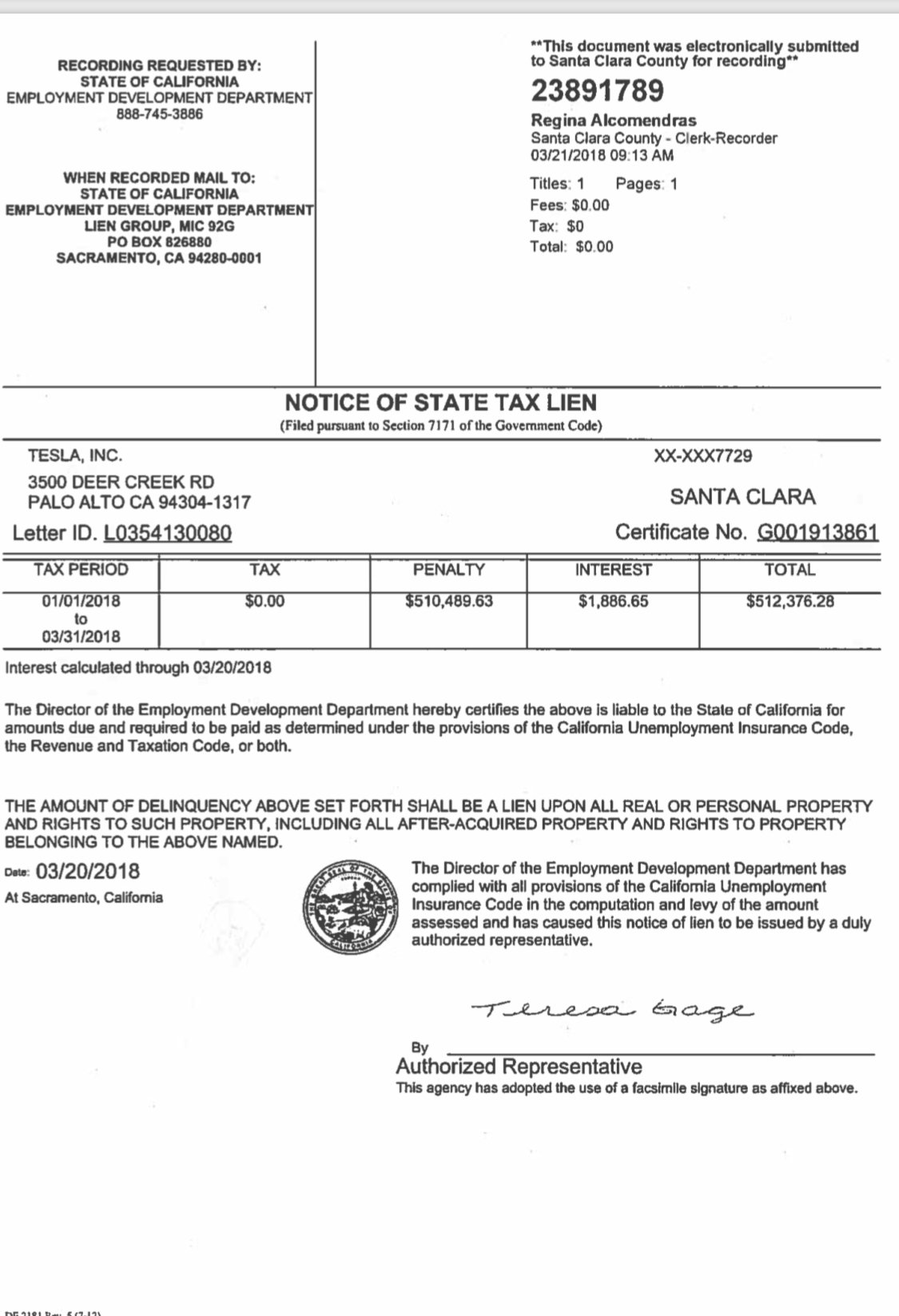

Although we don’t notify credit bureau agencies of the recording or filing of the notice of state tax lien, they may get the public record from either the county recorders or california.

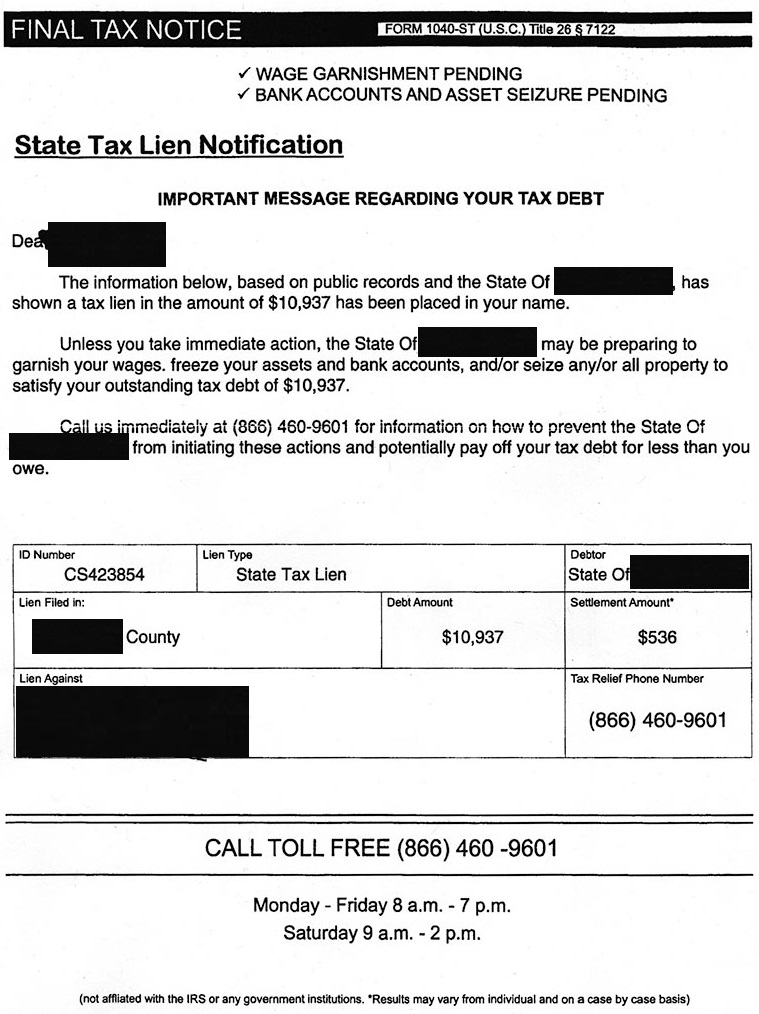

How to find out if you have a state tax lien. You can call them, visit them in person, or check out their website. As a result, taxpayers may receive notices from law firms working for the department regarding liens. How to find tax lien properties to find tax lien properties, you must contact your county’s tax collector.

Mortgage companies, financial institutions and taxpayers may obtain payoff information from the department upon request by going to georgia tax center and searching for a liens' payoff. The state tax lien registry is a public site accessible on the internet that may be searched by anyone at any time. The recorder’s office in your home county or state is the first place to search a federal tax lien.

First, you can either contact the irs or your state franchise board and secondly, you can use the resources of an online public. If you have any questions about a notice or a lien, please contact the department of. Seller collects sales tax /vat for items dispatched to the.

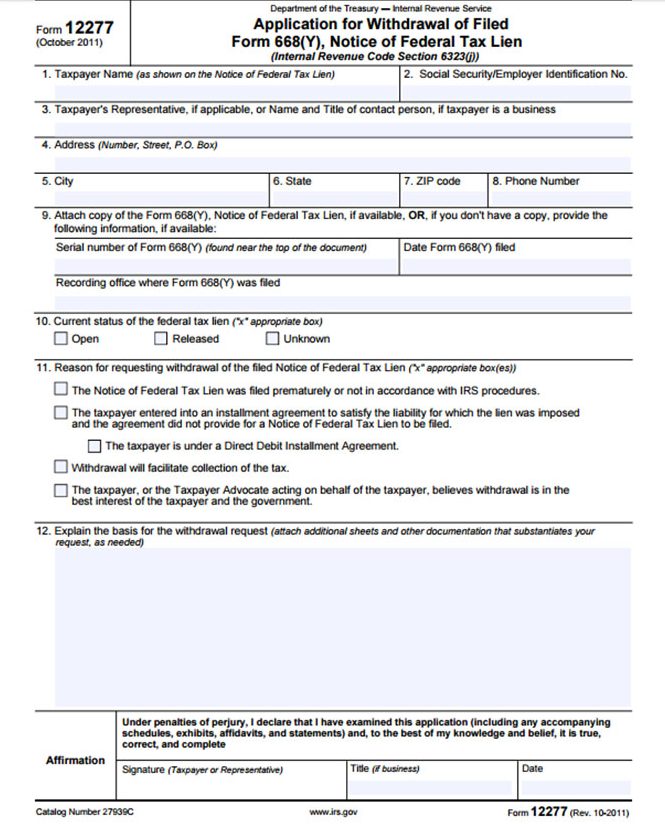

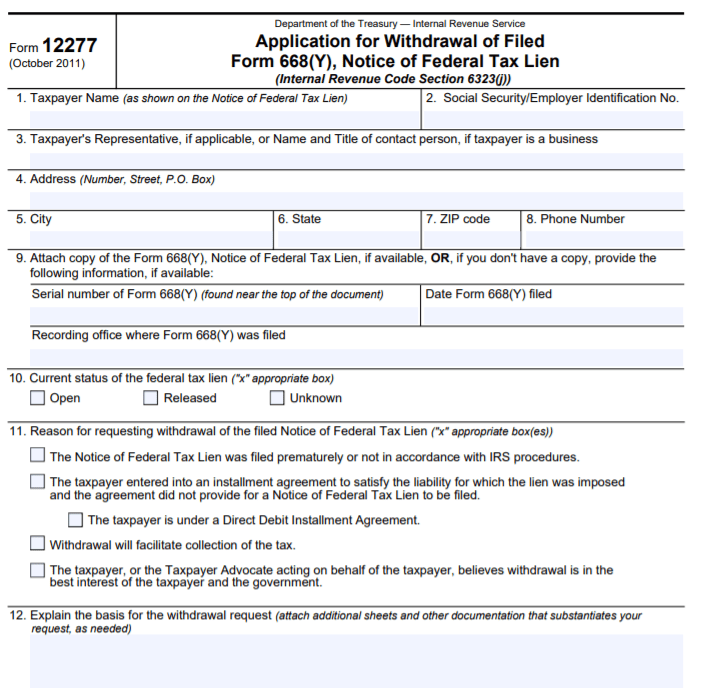

Don't let the irs intimidate you. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. The easiest way to find out if you have a tax lien is.

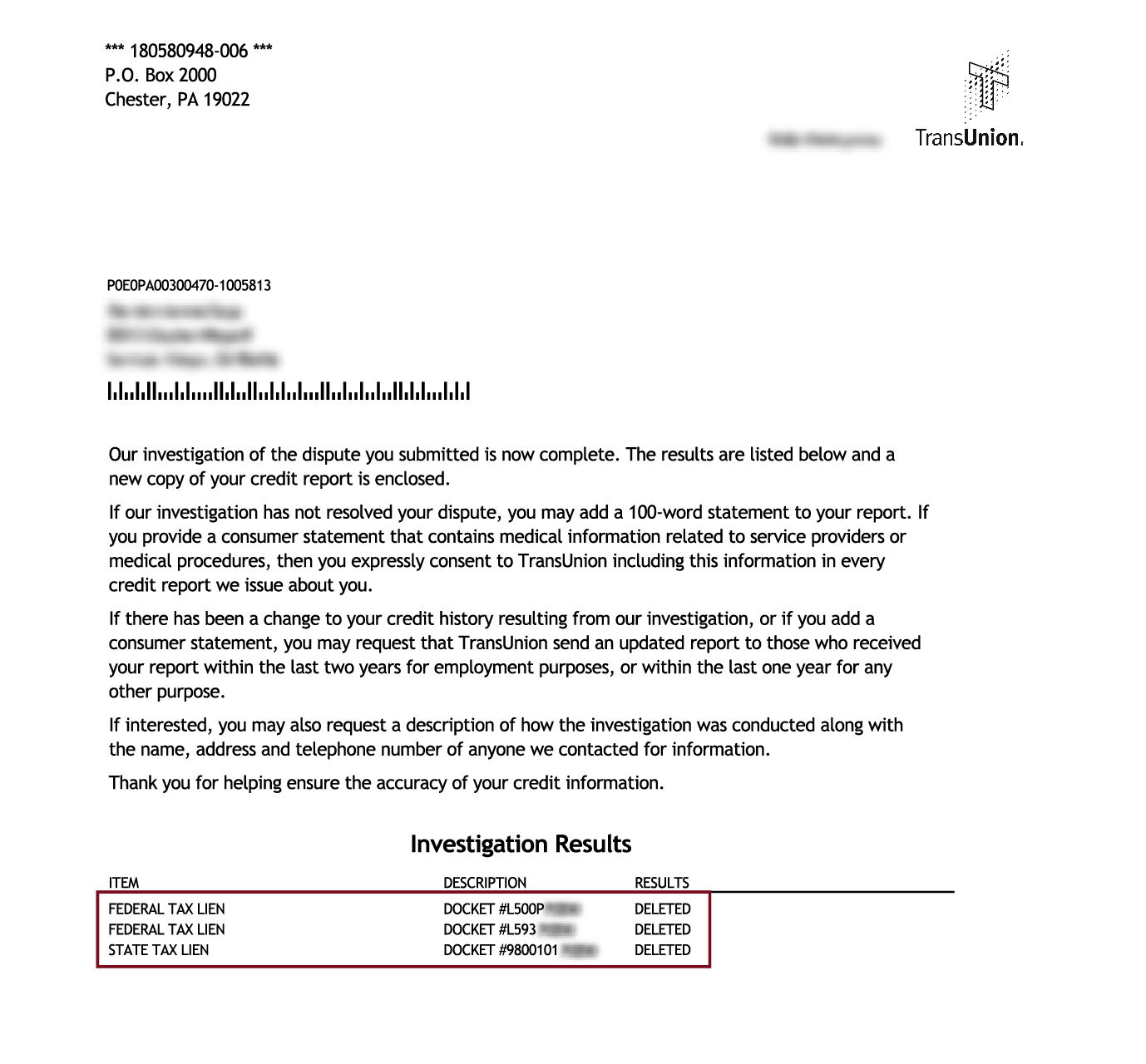

Both the internal revenue service (irs) and most states report these liens to all three major credit bureaus: If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. The state tax lien registration act also provided for the sale of state tax lien registry information.

(generally, these are debts for (1). How to buy state tax lien properties in tennessee real estate : You can call the irs directly.